This page goes over the various forms of payment which are available for use by a consumer and various ways to make the purchase while minimising the outgoing expense.

I will make a brief note that for many of the methods used here, while you the customer can save money, at the end of the day, you spend less money and either the business loses out or other customers are subsidising the cost for you. If you want to help out small business as customers, the best way to pay is with cash.

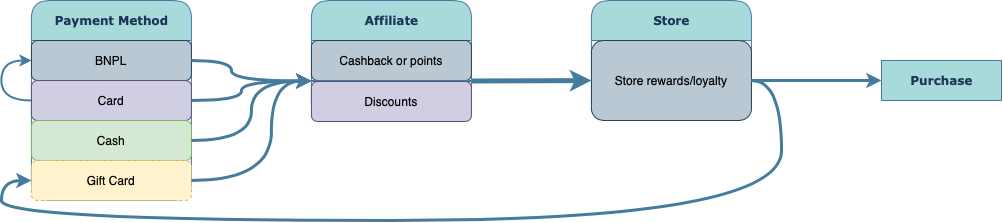

Flow Chart

This flow chart shows a way of maximising the value of your money when making purchases. Each step in the chain has its own additional way of minimising the spend value. Something that clearly stands out is that there is a potential for an infinite loop through purchasing gift cards with gift cards and a discount/cashback. Most stores will have a policy (though not necessarily enforced) that prevents you from purchasing gift cards using another gift card, or there will be a purchase fee for the more general gift cards to prevent the loophole. There are however, occasionally opportunities where you can exploit the loophole and increase your spending value.

Payment Method

By Now Pay Later (BNPL)

BNPL services provide a credit service that allows you to purchase an item and pay the item off at a later time. They all generally function the same way, however the things that sets them apart are their fee structures and rewards programs. Similar to credit cards, as long as you fully pay off the items before fees come in, they are a great way to pay for purchases.

As seen in the flow chart, you can get the BNPL reward and then double dip with a rewards card (e.g. points) when paying off the BNPL credit. The optimal way to us BNPL is to pay it off with a high points earning credit card before any fees are charged.

Afterpay, Latitudepay and Zip all occasionally have offers and discounts when making a purchase using their service.

Card

See Payment Accounts (inc. Credit Cards) for more details and recommendations on specific accounts and programs.

Card payments include Eftpos, Visa, Mastercard, American Express, Diner’s Club and any linked NFC phone payment (e.g. Apple Pay, Google Pay). One substantial negative of using card is that there are occasionally surcharges for certain card payments. You’ll have to compare the surcharge to the reward to determine if it’s worth using.

Rewards credit cards will generally provide rewards points on all (non-government) spend. These rewards points could be frequent flyer points or points from the card provider’s own rewards program (e.g. American Express, Flybuys, Commbank Rewards, Altitude Rewards etc.).

Some cards provide a direct cashback on purchases so you don’t have to jump through hurdles of redeeming rewards points. A good example of this is the HSBC Everyday Global which provides 2% back on all tap and pay purchases (with exceptions like government spend) under $100.

Your card providers may also occasionally have offers for bonus points or cashback through specific merchants if you look at the offers page of your account.

Cash

Cash is very simple. The only time when cash may provide a better reward compared to the other methods is if the merchant has a specific cash discount or offer.

Gift Card

See Gift Cards for more details.

Generally, gift cards are only worth it as a payment method if you could get some additional reward or discount for purchasing the gift card. As shown in the flowchart, using gift cards and claiming the reward at every step of the purchase could allow for stacking (potentially infinite) of the discount when eventually used to make your final purchase of a product.

It’s important to keep in mind that payment by gift card may exclude the ability to utilise other steps in the flowchart such as the affiliate step so it’s important to double check if there are any exclusions when making your product purchase.

Affiliate

This stage provides the largest potential for minimising your spend. They generally function by requiring you to click to the merchant’s website from the affiliate’s website (or app) and give you either cashback or points for doing so. Some also provide methods for you to purchase discounted gift cards.

Cashrewards and Shopback are the two biggest cashback providers in Australia. They both occasionally have extremely good promotional cashback offers from large retailers. They both also provide a gift card portal where you can buy certain gift cards at a discount and Cashrewards allows you to link your Australian Visa or Mastercard debit or credit cards to the account and earn cashback through them when purchasing in-store with the linked card.

Quandoo allows you to earn Qantas Frequent Flyer points when you do restaurant bookings through them.

Eatclub, Liven and TheFork all give very good rewards when you use them at restaurants and food venues. You can use your rewards card to pay through Liven and get a percentage of each payment back in points that can be used for the next time you pay with Liven. The downside is that you can’t redeem the points for cash, you can only use them for a discount next time or transfer them to another Liven account. Eatclub just gives you a direct discount of up to 50% off at certain venues and times. TheFork allows you to earn Yums which give a discount when redeemed, there are also various offers such a x% off. If you want to spend less but still go and eat out somewhere, you could choose your restaurant solely based on the highest savings from Eatclub, Liven or TheFork.

Store

Store loyalty programs are pretty straight-forward and a lot of places will offer them. They could be in the form of earning points to get a future discount or buy x number and get 1 free. It’s always a good idea to use the loyalty programs of any stores you shop at if you plan on continuing to shop there, as the alternative is continue shopping there without any additional benefits.

Some stores such as Coles and Woolworth with their Flybuys and Everyday rewards may require you to log on and activate certain offers to earn bonus points.

Example

I purchased a slab of beer at BWS which had a ticket price of $45.

I purchased a Coles Mastercard gift card at 10% off, the card had a value of $100 and $5 purchase fee so it cost $94.50 (5.5% off face value). I purchased the gift card with my Crypto.com card which gave 5% back (4.725% off face value). Unfortunately there is no option to stack rewards offers with gift card purchases at Coles to get an additional discount.

I went through Shopback who had a 30% cashback offer (30% off face value) and I checked my Everyday Rewards account which had an offer of 1000 bonus rewards points ($5 face value) for a spending $30+ at BWS (+46 regular points for the purchase), I paid with my Coles Mastercard gift card for the final purchase.

Summing all of the savings together yields (5% + 4.725% + 30%) * $45 + $5.23 = $23.10625 ≈ 51.35% discount. This discount is all excluding the regular BWS catalogue discount which brought the beer from the original price of $49 to $45. This means that I essentially spent only about $21.89 on the pack which was originally $49.

Paying Bills

Bills can generally be paid in many different ways, some of which attract fees. In general, to minimise how much you end up spending, you want to minimise the fees and maximise the rewards with the chosen payment method.

Payment By Card

Unfortunately, many billers who allow direct payment with card will also charge a surcharge for accepting this form of payment. Credit card billers will also usually not allow you to pay your monthly statement by card.

If your bill provider allows you to pay online directly with card and with no additional surcharge, then this is usually the best method as you’ll be paying the same amount but gain credit card rewards points. You would also be able to use your Mastercard or Visa gift cards that were already purchased at a discount (see page on Gift Cards). If the biller charges a surcharge then you may want to take the other payment methods into consideration. The next sections go over possible ways of still paying with a credit card and getting points but without the surcharge fees.

BPAY

BPAY is probably the most common way to pay bills as it is simple and almost all billers (including credit card bills) use it. Most billers don’t charge an additional fee for processing BPAY payments, however some do. Some BPAY billers will allow you to pay by card (which would also earn rewards points) through BPAY and this can be checked on their website. If they accept card payments, then this is another good method to use all of your low value Mastercard and Visa gift cards. Otherwise the payment can be made with an online transactions account.

There are a few additional payment methods that can be used to earn rewards points through BPAY where BPAY doesn’t directly allow for card payments.

- Beemit allows you to make BPAY payments directly with your credit card and with no fee and gets around the inability to pay certain BPAY bills with a credit card.

- Zip allows you to pay a bill up to your credit limit and only charge a flat $2.50 processing fee which may be better than the card surcharge from the biller. You are then able to pay off your Zip account with your rewards earning credit card and earn points for it. It should be noted that some bills/billers (such as credit card statements) are excluded from this feature.

- If you meet the monthly bonus requirements, paying BPAY via a Virgin Money Go Account will give 8 Virgin Money points worth between 36c – 45c depending on redemption method.

Post Billpay

Post Billpay functions similarly to BPAY however it also allows you to make payments in person at the post office… Or not. Their system is messy and the biller can set exactly which type of payment methods they accept and reject. There is no way to check online what the biller accepts and if you contact them, they might not have any idea what you’re asking because they don’t understand it either.

If your Post Billpay bill allows payment by card, then you can usually also earn rewards by paying with a credit card. If it allows split payments then you can spend all of your low value Mastercard and Visa gift cards.

If your Post Billpay bill allows payment in person, then it may or may not allow payment from a physical card as they don’t tell you. If it allows payment by credit card (Mastercard/Visa/American Express) then you may be able to earn points however you’ll need to check the Terms and Conditions of your card as payments at an Australia Post are common exclusions.

If it only allows Eftpos/cash then your only option on reducing the expense would be by getting a discounted Eftpos gift card (see page on Gift Cards). The assistant might try to stop you if they see you try and pay with a gift card but there’s nothing preventing the payment from going through.